Are you a South Florida homeowner that has recently been served with a Foreclosure Lawsuit or is currently in Foreclosure? You need an aggressive Broward Foreclosure Defense Attorney on your side.

Learn MoreAre you a Florida homeowner in Broward, Palm Beach or Miami-Dade County, that is struggling with your monthly mortgage payments to the Bank? 954 Foreclosure Attorneys can assist you.

Learn MoreAre you a Florida homeowner in Broward, Palm Beach or Miami-Dade County that needs to sell your property through a Short Sale? 954 Foreclosure Attorneys, can assist you.

Learn MoreForeclosure Defense Lawyers

The Foreclosure Defense Lawyers at 954 Foreclosure Attorneys understand that homeownership has always been part of the American Dream. As a result of unforeseen circumstances, a homeowner can fall behind on their mortgage payments resulting in the Bank filing a foreclosure action against them.

With the economy turning, homeowners are feeling the squeeze now more than ever. Whether it be that homeowners are out of work, benefits are no longer coming in, or some other unexpected changes of events, mortgage payments still accrue on a monthly basis. As Florida homeowners deal with these unforseen circumstances, the foreclosure defense lawyers at our office are here to help and advocate on your behalf against the Banks and the Bank's lawyers.

Our Broward Foreclosure Defense Lawyers and West Palm Beach Foreclosure Defense Lawyers at 954 Foreclosure Attorneys, PLLC have been defending foreclosures for homeowners since 2010 and they employ a variety of strategies against the Bank and their deceitful tactics. Our foreclosure defense law firm helps the homeowner defend against foreclosure and require the Bank to prove that they have the right to bring the foreclosure lawsuit against you. If you are a homeowner and have been served with a foreclosure lawsuit or foreclosure summons in Broward County or Palm Beach County, let us help you fight back against the Bank! The Foreclosure Defense Lawyers at 954 Foreclosure Attorneys, PLLC will make every effort to help stop the foreclosure and give you the justice you deserve as a homeowner.

Loan Modification Lawyers

954 Foreclosure Attorneys, PLLC takes great pride in helping homeowners save their homes from foreclosure. There are many factors that can cause a homeowner to default on their monthly mortgage payment including loss of employment and increased monthly bills. 954 Foreclosure Attorneys, PLLC are South Florida Foreclosure Defense Lawyers that can assist with Bank negotiations to help you attempt to obtain a mortgage payment that is more affordable and fits your economic needs. The Foreclosure Defense Attorneys at 954 Foreclosure Attorneys, PLLC understand that the loan modification process can be stressful and time consuming as it is extremely difficult to reach someone at the Bank that will work with you. Our foreclosure defense law firm handles the entire loan modification process from the beginning to the end. This includes handling all correspondence with the Bank on behalf of the homeowner to ensure that the Bank receives the necessary documentation required for a loan modification to be processed and considered. If you are a homeowner and are having difficulty obtaining a loan modification, 954 Foreclosure Attorneys, PLLC are here to help!

Short Sale Lawyers

954 Foreclosure Attorneys, PLLC understands that the foreclosure process can have many negative consequences for the homeowner. This sometimes includes a deficiency judgment that the Bank can obtain against a homeowner that loses their property to foreclosure. If the Bank obtains a deficiency judgment against the homeowner, the Bank will have the right to continue to collect against the homeowner. This can be a nightmare for a homeowner that is already dealing with financial struggles. To avoid losing your property to foreclosure and receiving a deficiency judgment, 954 Foreclosure Attorneys, PLLC sometimes recommends that a homeowner sell their property through the short sale process if a loan modification is not feasible and all loss mitigation attempts have been exhausted. If a Florida homeowner is successful in selling their property through an approved short sale, the Bank will usually choose not to pursue a deficiency judgment against the homeowner and the impact on their credit will not be as severe as Final Judgment of Foreclosure. 954 Foreclosure Attorneys, PLLC has a highly qualified team of Broward Short Sale Attorneys and West Palm Beach Short Sale Attorneys that assist homeowners with selling their distressed property through the short sale process. If you are a homeowner in Broward County or Palm Beach County and are interested in exploring your options by selling your property through the short sale process, call your Broward Foreclosure Defense Lawyers and West Palm Beach Foreclosure Defense Lawyers at 954 Foreclosure Attorneys today!

Top 3 Mistakes Florida Homeowners Make When Served With Foreclosure

1. Do Nothing The worst mistake a Florida Homeowner can make is to not respond to the Foreclosure Complaint. If a Homeowner fails to respond to the Complaint, the Bank can quickly obtain an uncontested Final Judgment of Foreclosure against the Homeowner and ultimately sell the property at the Foreclosure auction. This can be disastrous for a Homeowner because they will lose their right to attempt loss mitigation efforts by trying to keep the property or to sell their property through a regular sale or a short sale. The Foreclosure process can be extremely stressful for a Florida Homeowner and their family but if you fail to take any action, a Homeowner will find themselves in an even worse position.

2. Not Having a Plan of Action Upon being served with a Foreclosure complaint, the Homeowner should always have a plan of action. Many Florida Homeowners think that once they are in Foreclosure, they do not have any rights and they will ultimately lose their property. This may be completely untrue. If a Homeowner wants to attempt to keep their property, a homeowner can try to obtain a Loan Modification. If a Homeowner qualifies for a Loan Modification and submit all three trial payments to the Bank, they will likely be able to keep their property. It does not matter that a Homeowner is currently in Foreclosure if the Bank offers them a Loan Modification. The great benefit of obtaining a Loan Modification is that once all three payments are submitted and a permanent modification is offered, the Bank will dismiss the Foreclosure against the Homeowner. The Homeowner also has the option of selling their property through a regular sale if they have equity in the property or a Short Sale if they owe more than the value of the property. If a Homeowner is successful by selling their property through a Short Sale or a regular sale, the Bank will dismiss the Foreclosure against them. Therefore, it is extremely important that the Homeowner have a plan of action when they are served with a Foreclosure lawsuit. A Homeowner should always educate themselves on their options immediately when they are served.

3. Not Hiring Competent Foreclosure Defense Counsel Hiring competent Foreclosure Defense Attorneys in the State of Florida is not only critical to defending your Foreclosure case, it is also critical to keeping your home. A competent Florida Foreclosure Defense Lawyer will be able to fight the Bank while helping you to attempt to qualify and obtain a Loan Modification or guide you accordingly in your efforts to sell your property. Many Florida Homeowners hire attorneys that fail to respond to them or file the proper documents in Court that are beneficial in defending your Foreclosure case. 954 Foreclosure Attorneys, PLLC have a combined experience of over twenty (20) years working with Foreclosures and our Foreclosure Defense Attorneys continue to fight on behalf of their clients each day.

The Benefits of Foreclosure Defense Attorneys in Florida

The Foreclosure process can be extremely stressful for a Florida Homeowner and their family. The fear of losing one’s home can take a drastic toll on a Homeowner negatively affecting all aspects of their life. Homeownership is generally considered a person’s most important investment of their lifetime. Losing this investment can not only affect your current economic situation but can negatively affect your retirement. That is the bad news. The good news is that if a Homeowner in Foreclosure takes action and actively defends the Foreclosure filed against them, the negative effects that come with a Foreclosure can be reduced greatly.

A major benefit of hiring a competent Foreclosure Defense Attorneys is that you now have several options to afforded to you while your case is being actively defended. While these options are available to you without obtaining counsel, you will have more time to explore the possibility of a Loan Modification or selling your property though a Short Sale if your case is actively being defended. The Loan Modification process can sometimes take over a year and if you are not defending the Foreclosure, you may lose not only and opportunity, but also that property within a year. A Short Sale can also take over a year to complete and without adequate Foreclosure Defense Attorneys, you may also lose that property during that time if the Courts push your case through at a rapid pace.

Another benefit of hiring Foreclosure Defense Attorneys to defend the Foreclosure filed against you is that you will be constantly informed regarding the status and posture of your Foreclosure case. This is extremely important because you do not want to be caught by surprise that you are losing your home and you did not have any knowledge of it happening. Competent Foreclosure Defense Attorneys hired to defend your Foreclosure action will provide you an idea of how much time you have left remaining in your property and what needs to occur if you decide you want to keep it. If you decide to relocate or vacate the property, you need to be sure that you will be given this opportunity to move without fear of the sheriff coming to your property and physically removing you. Therefore, regardless of your overall intentions after being served with a Florida Foreclosure complaint, it is extremely important to take action and defend your case so you can determine what course of action is best for you.

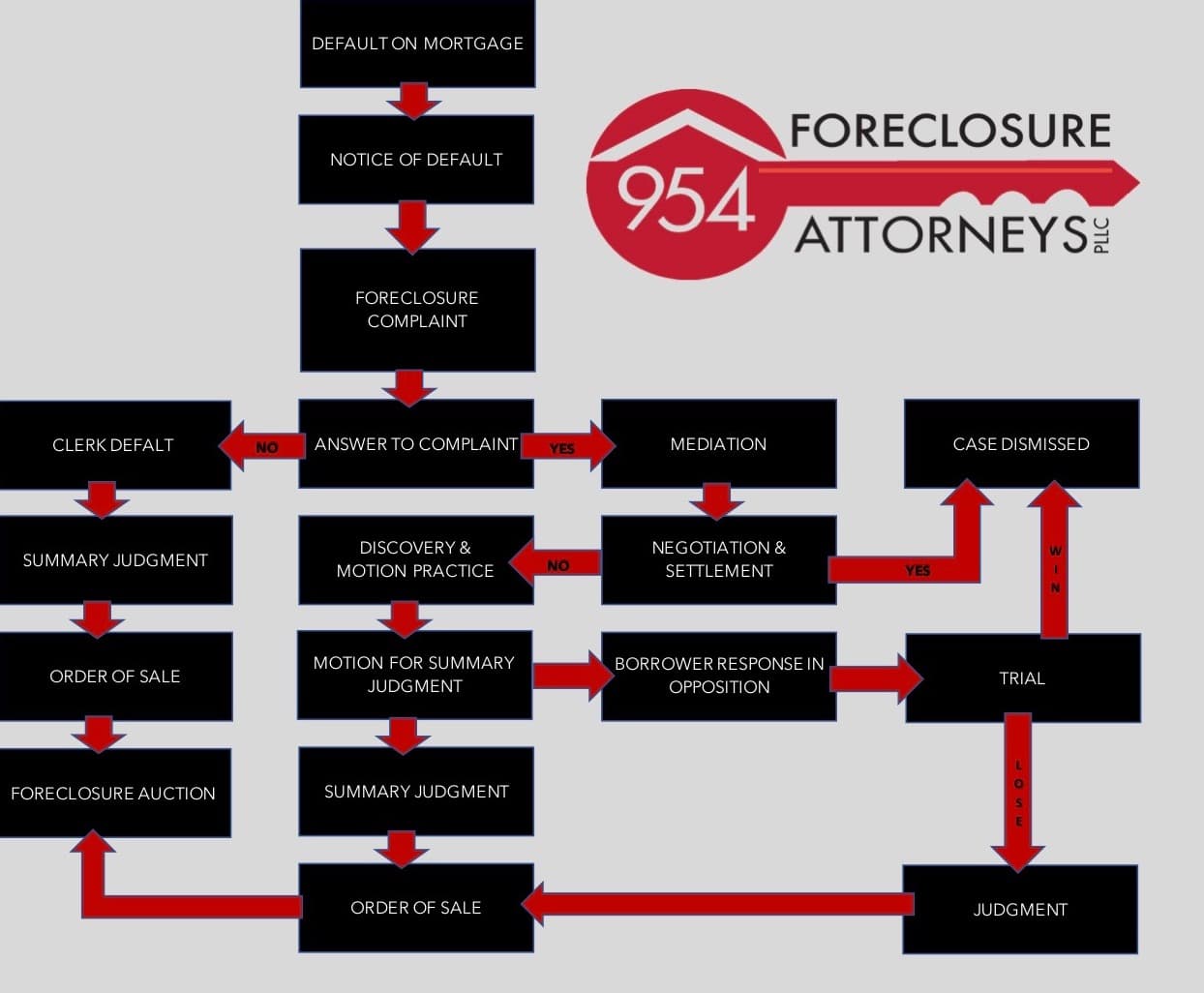

Florida Foreclosure Flowchart | Florida Foreclosure Process Step By Step

Condominium and Homeowners' Association Lien Foreclosure Defense

When people think of Foreclosure, they immediately assume that the Bank has filed a lawsuit against a Homeowner that has not paid their mortgage. While the Bank does have the right to pursue a Foreclosure action against a Homeowner that is behind on their mortgage, a Condominium Association or Homeowners’ Association (the “Association”) also has that same right. However, in the case of an Association, the Foreclosure is a called a "Lien Foreclosure" and the action traditionally deals with unpaid assessments, unpaid maintenance dues, unpaid special assessments, and/or fines assessed against the property.

Upon being served with Florida Lien Foreclosure paperwork from the court, it is extremely important that you thoroughly and accurately review the complaint and its accompanying exhibits to determine if the amounts that the Association is seeking to collect is accurate and allowed to be collected for according to both the Association’s Governing Documents and Florida Statutes 718 (Condos) or 720 (HOA). If you find that the numbers are accurate or if you have a discrepancy as to the amounts being claimed due, it is highly recommended that you seek the services of knowledgeable Lien Foreclosure Defense Attorneys who have experience in defending Lien Foreclosures from Homeowners’ Associations and Condominium Associations throughout the State of Florida.

At a miniumum, before the commencement of the actual Lien Foreclosure lawsuit for non-payment, the Association must first send out a proper Notice of Intent to Record a Claim of Lien and then after a certain amount of time has elapsed in accordance with the governing documents and Florida Statutes, the Association must then send the Homeowner a Notice of Intent to Foreclose on the Claim of Lien and record a Lien with the county wherein the property is located. These requirements must be complied with prior to the commencement of a Florida Lien Foreclosure lawsuit.

In most Association Lien Foreclosure lawsuits, the Homeowner has the opportunity to negotiate with the Association to enter into a payment plan or some other type of arrangement that will hopefully allow the Homeowner to get caught up and to keep their property while the Association is able to get paid.

It is very important for the Homeowner to understand that once they are served with an Association Lien Foreclosure Lawsuit, the Homeowener should not wait until the property is set to be sold at a Foreclosure auction before taking action. As time goes on, Attorneys’ fees and costs, dues, interest, and late fees will continue to accrue thereby making settlement with the Association that much more difficult. If you are served with a Lien Foreclosure lawsuit either by your Condominium Association or Homeowners’ Association, contact your Lien Foreclosure Defense Attorneys today. For all other owner disputes with Condo or HOA Associations, please contact our parent law firm: Shipp Law Office.

Florida Foreclosure Defense Attorneys by City and County:

- Saint Lucie County Foreclosure Defense Lawyers

- Fort Pierce Foreclosure Defense Lawyers

- Port Saint Lucie Foreclosure Defense Lawyers

- Martin County Foreclosure Defense Lawyers

- Stuart Foreclosure Defense Lawyers

- West Palm Beach Foreclosure Defense Lawyers

- Miami Foreclosure Defense Lawyers

- Palm Beach County Foreclosure Defense Lawyers

- Broward County Foreclosure Defense Lawyers

- Dade County Foreclosure Defense Lawyers

- Fort Lauderdale Foreclosure Defense Lawyers

- Lantana Foreclosure Defense Lawyers

- Coral Springs Foreclosure Defense Attorneys

OFFICE LOCATIONS

Important Florida Foreclosure Resources

- Florida Foreclosure Filings Statewide Statistics

- Miami-Dade Foreclosure Filings Statistics

- Broward County Foreclosure Auction Calendar

- Palm Beach County Foreclosure Auction Calendar

- Residential Foreclosure Bench Book

- Foreclosure Help- The Florida Bar

- All Florida Counties Property Appraiser

- All Florida Counties Tax Collector

- 6 Mortgage Foreclosure Workout Options